Colorado Homestead Exemption 2024. Lc 44 2531 is aimed at. The state legislature can adjust the $200,000 amount to either increase or decrease the homestead exemption.

Homestead exemption for property tax year 2024 by $267,954. This comprehensive guide covers everything you need to know about these adjustments, including how they might affect your tax bill in 2024.

In Colorado, Spouses Cannot Double The Homestead.

Single is 65 or older:.

The Senior Property Tax Exemption Is Available To Senior Citizens And The Surviving Spouses Of Senior Citizens.

The homestead exemption is often broken down by age and whether you are married.

The Homestead Exemption Is $350,000 If The Homeowner, Spouse, Or Dependent Is Disabled Or 60 Or Older.

Access senior citizens and veterans exemption.

Images References :

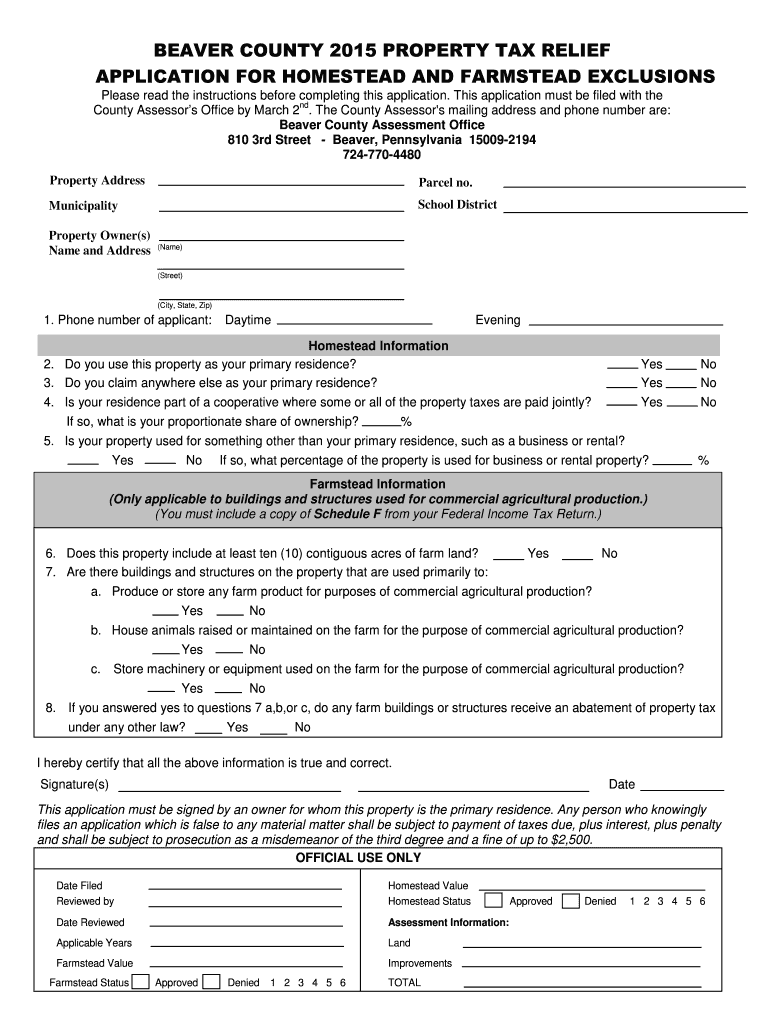

Source: www.dochub.com

Source: www.dochub.com

Homestead related tax exemptions Fill out & sign online DocHub, That means the 2024 refund pool would be reduced. Access senior citizens and veterans exemption.

Source: www.signnow.com

Source: www.signnow.com

Montgomery County Homestead Exemption 20192024 Form Fill Out and, The homestead exemption is often broken down by age and whether you are married. That means the 2024 refund pool would be reduced.

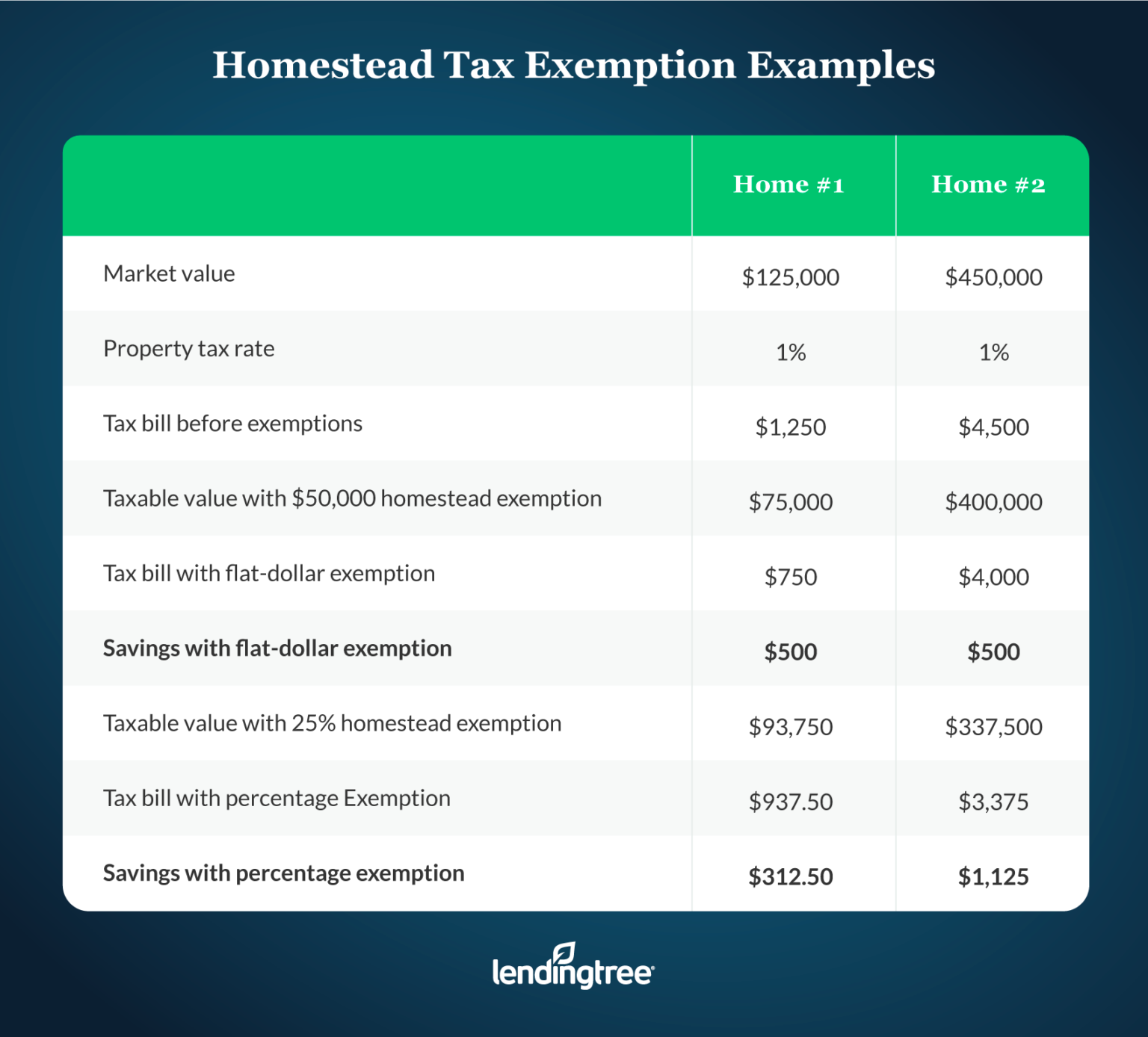

Source: www.lendingtree.com

Source: www.lendingtree.com

What Is a Homestead Exemption and How Does It Work? LendingTree, Colorado's statutory homestead exemption exempts a portion of a homestead from seizure to satisfy a debt, contract, or civil obligation. Section 2 increases the amount of the.

Source: www.insuranceandestates.com

Source: www.insuranceandestates.com

Homestead Exemptions By State With Charts Is Your Most Valuable Asset, Homestead exemption for property tax year 2024 by $267,954. Start small and grow mighty m1 finance review:

Source: www.christybuckteam.com

Source: www.christybuckteam.com

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team, Property tax exemption for senior citizens in colorado. A homestead exemption is a legal provision that helps shield a home from some creditors following the death of a homeowner spouse or.

Source: mybios.me

Source: mybios.me

What Is A Homestead Exemption For Property Ta Bios Pics, The homestead exemption is $350,000 if the homeowner, spouse, or dependent is disabled or 60 or older. The state reimburses the local governments for the loss in revenue.

Source: mysouthlakenews.com

Source: mysouthlakenews.com

homestead exemption MySouthlakeNews, This comprehensive guide covers everything you need to know about these adjustments, including how they might affect your tax bill in 2024. Section 2 increases the amount of the.

Source: www.dochub.com

Source: www.dochub.com

Beaver county homestead exemption Fill out & sign online DocHub, The filing deadline is july 1. The state legislature can adjust the $200,000 amount to either increase or decrease the homestead exemption.

Source: www.dochub.com

Source: www.dochub.com

Lorain county homestead exemption Fill out & sign online DocHub, Homestead exemptions by state 2024. Property tax exemption for disabled veterans in colorado.

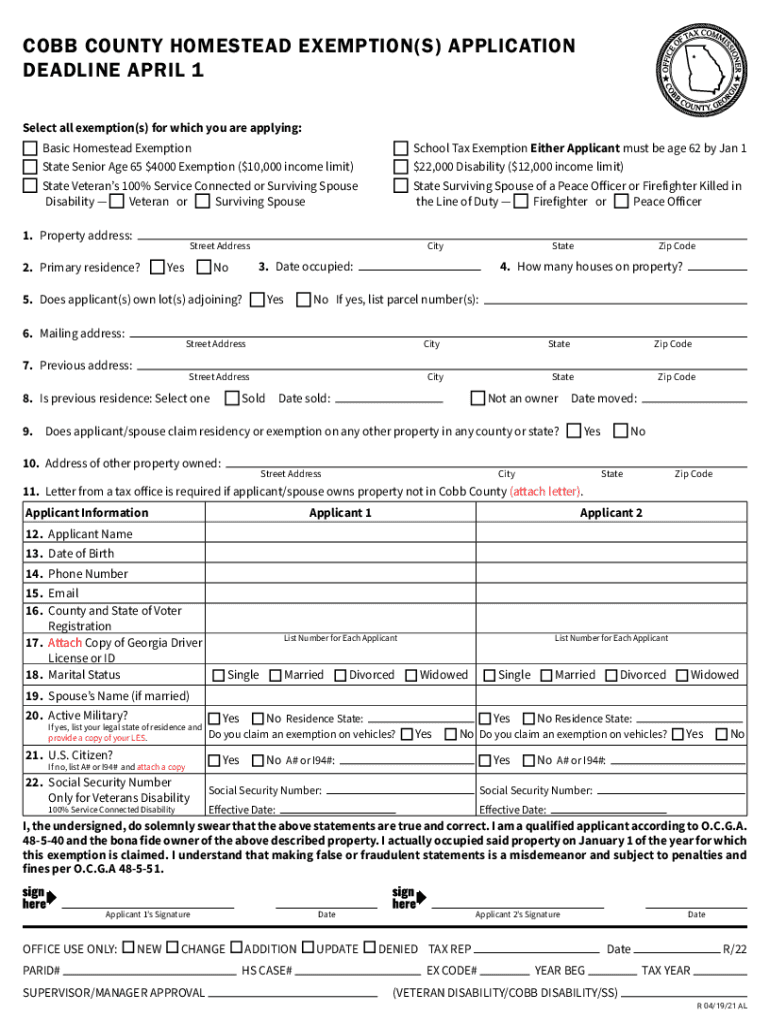

Source: www.signnow.com

Source: www.signnow.com

Cobb Homestead Exemptions 20212024 Form Fill Out and Sign Printable, Homestead exemption for property tax year 2024 by $267,954. Colorado homestead exemption section 3.5 of article x of the colorado constitution grants a property tax exemption to qualifying senior citizens and disabled veterans, commonly.

Colorado Homestead Exemption Section 3.5 Of Article X Of The Colorado Constitution Grants A Property Tax Exemption To Qualifying Senior Citizens And Disabled Veterans, Commonly.

Summit county nonprofit works to make after school,.

The Senior Property Tax Exemption Is Available To Senior Citizens And The Surviving Spouses Of Senior Citizens.

The change in reimbursements assumes an estimated average exemption amount of $595 and 4,700.

Single Is 65 Or Older:.

The state would trim individual 2024 refunds by about $46 on average, for a total reduction of about $167 million.

Category: 2024